Anatomy of a Deal: an insight into our lending process

11 June 2019

When Qualitas closes a transaction, it’s the culmination of many steps by a skilled team. As a specialist real estate financier, each investment we make is different, requiring a range of skills to bring it to fruition.

This rigorous process is the reason Qualitas has maintained a strong track record of performance over the last decade, and this article explains what happens behind the scenes to achieve this.

Finding the opportunities

When it comes to finding investment opportunities, relationships and reputation are key. The loan origination team has established an extensive network of contacts in the commercial real estate debt market who understand our offering and funding solutions.

In addition, as the volume of our business has increased over the past decade, Qualitas has invested in building our profile among potential borrowers and other market participants, so they are aware of our capabilities as an alternative lender.

A significant number of our transactions are with existing clients. When we assess a transaction, the two key elements we look at are the quality of the borrower and the quality of the security property. It’s therefore an advantage when we are already acquainted and are comfortable with the borrower. We pride ourselves on doing multiple deals with the same client.

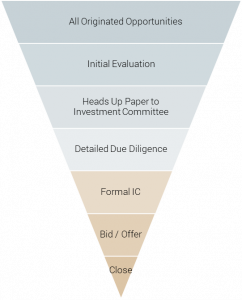

Once a potential client speaks to us about their funding needs, we’ll undertake initial review to decide if it’s a good fit for our portfolio, investment principles and lending appetite. This filtering process is rigorous, with only a select number moving to the next stage.

If we move to the next stage, the investment team will issue indicative terms to the client, including pricing and conditions, to facilitate further negotiations. Once finalised, this leads us into deep due diligence.

Due diligence

There are two key areas of focus:

1) The client, their experience and financial position – The investment team will request and gather detailed information about the client which includes their business operations, track record, management team, company owners, financials and property portfolios.

2) The quality of the asset we will be funding – Qualitas loans are secured by real property assets, so it’s important that we verify the asset’s quality, such as whether it could be resold or leased out, the location, and its supporting demographics.

At this point we take a deep dive into the property asset being funded. If it’s a construction loan provided to a residential project, for example, we will look into the pre-sales achieved and profile of the purchasers, the location, the builder, the construction contract, the site specifics and the overall desirability and market appropriateness of the end product.

If it’s a land loan or an investment loan there are different aspects to consider depending on the asset type. For example, we may look at potential cashflow, or plans for future use or development.

The ultimate goal is to ensure that all risks are identified, mitigated, managed and priced appropriately. The risk management team is closely involved, conducting a parallel process in preparation for the Qualitas Investment Committee (IC), to obtain initial endorsement of the loan.

Investment Committee approval

Once due diligence has been completed, and we are comfortable with the risk parameters, the investment team prepares a formal detailed paper to be submitted to the IC for approval. This is a committee comprised of Qualitas senior executives, risk team members and independent Advisory Board members.

The IC then holds a formal IC meeting with the investment team and scrutinises the investment analysis and recommendation from all angles.

Figure. 1 – Indicative Deal Filtering Process

Documentation

Once approved, the deal moves ahead to documentation stage. This is the point where legal loan and security documents are drawn up and the multiple checks and balances are applied to ensure the lender’s interest is protected.

After final steps to ensure all the conditions have been met, the deal is closed and the loan funds advanced.

However, the transaction isn’t over the day the documents are signed: Qualitas remains involved in the loan management for the life of the loan.

Loan management

Our active management approach varies depending on the loan and asset type. For a cashflow-producing asset such as an office or industrial building, we actively monitor the cashflow from the tenants and therefore the performance of the asset.

For a construction loan, our team stays close to the building process, meeting on-site monthly and being across any emerging issues, calling on our in-house development experts if required.

The investment and risk management teams work closely with each other, undertaking an intensive loan Portfolio Asset Management review every 6-8 weeks.

Conclusion

The Qualitas origination and investment process has many steps and layers, it means that we can enter into a transaction with confidence, having considered all the risks carefully and priced the transaction appropriately.

By applying a rigorous risk analysis that protects our investors, and building long-term relationships with clients, Qualitas has created a strong and sustainable real estate finance business.

Q&A – Nick Bullick, Director, Real Estate Finance

Q&A – Nick Bullick, Director, Real Estate Finance

What’s your approach to finding new business opportunities?

It’s all about building a network and fostering relationships over the long term and getting word of mouth recommendations. I make sure I’m always talking to a wide range of people, because you just don’t know where the next opportunity will come from.

Over your 15-year career, how has the CRE lending sector changed?

The fundamentals of origination haven’t changed: it’s all about relationships and the client experience.

In our business price is not the key differentiator – it’s about execution and delivery. This means giving the client certainty and doing what you’ve said you will do.

What has changed is the expanding appetite of borrowers and the size of the deals we are doing. As the banks have retreated from the sector, we are seeing bigger, more sophisticated clients looking to alternative lending.

What are the key factors you look for when assessing an opportunity?

We look closely at the potential borrower and the asset they are funding – who are they, their track record, their strategy for the asset, and do they have the right people and support in place to achieve that?

What’s the biggest lesson you’ve learned in your career?

No two deals are alike, so you’re always learning – facing new challenges and coming up with new solutions. You learn something from every deal and every client.

Disclaimer

This communication has been issued by The Trust Company (RE Services) Limited (ACN 003 278 831) (AFSL 235150) as responsible entity of The Qualitas Real Estate Income Fund (ARSN 627 917 971) (Fund) and has been prepared by QRI Manager Pty Ltd (ACN 625 857 070) (AFS Representative 1266996 as authorised representative of Qualitas Securities Pty Ltd (ACN 136 451 128) (AFSL 34224)).

This communication contains general information only and does not take into account your investment objectives, financial situation or needs. It does not constitute financial, tax or legal advice, nor is it an offer, invitation or recommendation to subscribe or purchase a unit in the Fund or any other financial product. Before acting on any information contained in this communication, you should consider whether it’s appropriate to you, in light of your objectives, financial situation or needs.

While every effort has been made to ensure the information in this communication is accurate; its accuracy, reliability or completeness is not guaranteed and none of The Trust Company (RE Services) Limited (ACN 003 278 831), QRI Manager Pty Ltd (ACN 625 857 070), Qualitas Securities Pty Ltd (ACN 136 451 128) or any of their related entities or their respective directors or officers are liable to you in respect of this communication. Past performance is not a reliable indicator of future performance.